Building wealth effectively within superannuation is an important consideration for mining and resources personnel, particularly when a change in super legislation may be of benefit. 2018/19 is the first financial year you may be able to boost your superannuation balance by carrying forward unused superannuation concessional contributions cap amounts. Part of the Government’s superannuation reforms, this ‘catch-up’ measure offers greater flexibility and it may help you to top up your super savings – significantly!

Having financial strategies in place is essential for your success both professionally and personally and now is the time to review your super strategy in light of the new concessional contributions catch-up provision.

How it works

From 1 July 2018, if your total super balance on the June 30 of the previous year was less than $500,000 and your concessional contributions total was less than the $25,000 annual cap, from 1 July 2019 you may be able to carry forward unused cap amounts for up to five years.

For those who are eligible, the benefits of carrying forward concessional contributions include the opportunity to accumulate additional retirement savings. Australians using non-superannuation assets may be able to use the additional concessional contributions to offset some of the tax liability on any realised capital gains. Further, the catch-up provision may assist you to manage your tax obligations. For example, tax deductions may be available for concessional contributions made. The catch-up concession provision may be useful if your income varies year to year, as you may choose to exercise this option in your higher income years.

Who may benefit?

If you take parental leave or a career break and you are not able to make concessional contributions up to the $25,000 annual cap, the catch-up provision may help you make up for it by carrying forward the unused cap amount once you return to work. Similarly, you may be eligible if you are do not make the maximum concessional contribution for other reasons.

For example, many Australians find it a challenge to make contributions up to the $25,000 concessional contribution cap while paying home loans, school fees and meeting lifestyle costs for children still living at home. Once you own your home, school fees finish and your kids have left, you may have additional cash flow which can be used to catch-up your concessional contributions. Carrying forward unused cap amounts may even enable you to contribute more than the standard $25,000 annual cap.

If you receive an inheritance or you’ve realised a capital gain through selling investments, the catch-up measure may enable you to use some or all of these funds to top up your super as concessional contributions.

Business owners enjoying increased profitability may be able to use the extra cash flow to make concessional contributions. Likewise, individual wage earners enjoying a salary increase may wish to use the surplus cash flow to make concessional contributions to their super.

Scenario

Elizabeth is 41 and earns $130,000 pa. She has approximately $350,000 in accumulated superannuation on 30 June 2018. The only superannuation contributions being made by Elizabeth or on her behalf are the Superannuation Guarantee contributions (currently $12,350 per annum) paid by her employer.

Elizabeth’s unused concessional contributions cap in 2018/19 will be $12,650 (ie $25,000 concessional contributions cap less $12,350 superannuation guarantee contributions). Her unused concessional contributions cap will accrue each year until it is either used or falls outside the five-year carry-forward period.

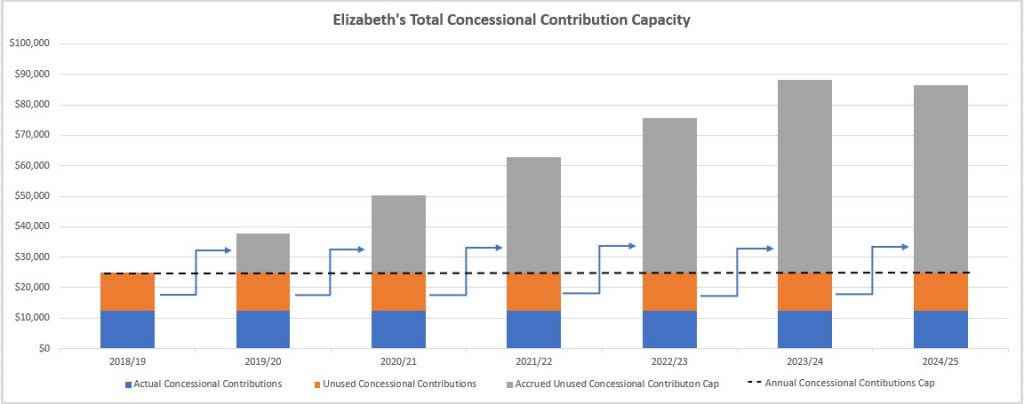

The chart below illustrates Elizabeth’s total concessional contributions capacity over a seven-year period.

Assumptions:

- Elizabeth satisfies the eligibility criteria listed below.

- The annual concessional contributions cap remains at $25,000 over the next five years.

Disclaimer: The above projection is for comparison purposes only and is not a guarantee. The projection is not intended to be your sole source of information when making a financial decision. You should consider whether you should seek advice from a licensed financial adviser before making any financial decision.

The black dotted line on the chart is the standard annual concessional contributions cap of $25,000.

The blue shaded area represents Elizabeth’s actual concessional contributions each income year.

The orange shaded area is her unused concessional contributions cap each year, which is carried forward.

The grey shaded area represents Elizabeth’s accrued unused concessional contributions cap from year to year.

The unused cap continues to increase until 2023/24 when Elizabeth reaches her maximum concessional contribution carry-forward position. This is the point where she’ll be able to apply her unused concessional contributions cap of $63,250 from the previous five financial years, assuming she meets the eligibility conditions outlined below.

This unused concessional contributions cap is applied in addition to the standard concessional contributions cap of $25,000, bringing her total concessional contributions capacity in 2023/24 to $88,250.

In 2024/25, Elizabeth’s unused concessional contributions from 2018/19 will no longer be available as they will be outside the five-year carry-forward period.

Are you eligible?

To be eligible to make additional concessional contributions in a financial year using the new carry-forward provision, you must:

- make concessional contributions that exceed the annual concessional contributions cap of $25,000;

- have a total superannuation balance of less than $500,000 on the previous 30 June; and

- have an unused concessional contributions cap amount available from one or more of the previous five financial years.

Your next step…

Making the most of your opportunities in mining and resources means having an appropriate superannuation strategy in place. To review your super strategy and find out whether you and your family can take advantage of the superannuation concessional contributions catch-up provision, please contact Brett on (07) 3007 2000 or email info@stratusfinancialgroup.com.au

Stratus Financial Group and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This is general advice only and does not take into account your objectives, fi